If for example your car is worth 10000 and its private use is 33 CAs would be 18 of 10k or 1800 but as you claim is restricted by 33 then you would only actually be. Ad Car allowances cost you AND your employees money and decrease productivity.

Capital Allowance Explained Isuzu Trucks

New and unused cars with CO 2 emissions.

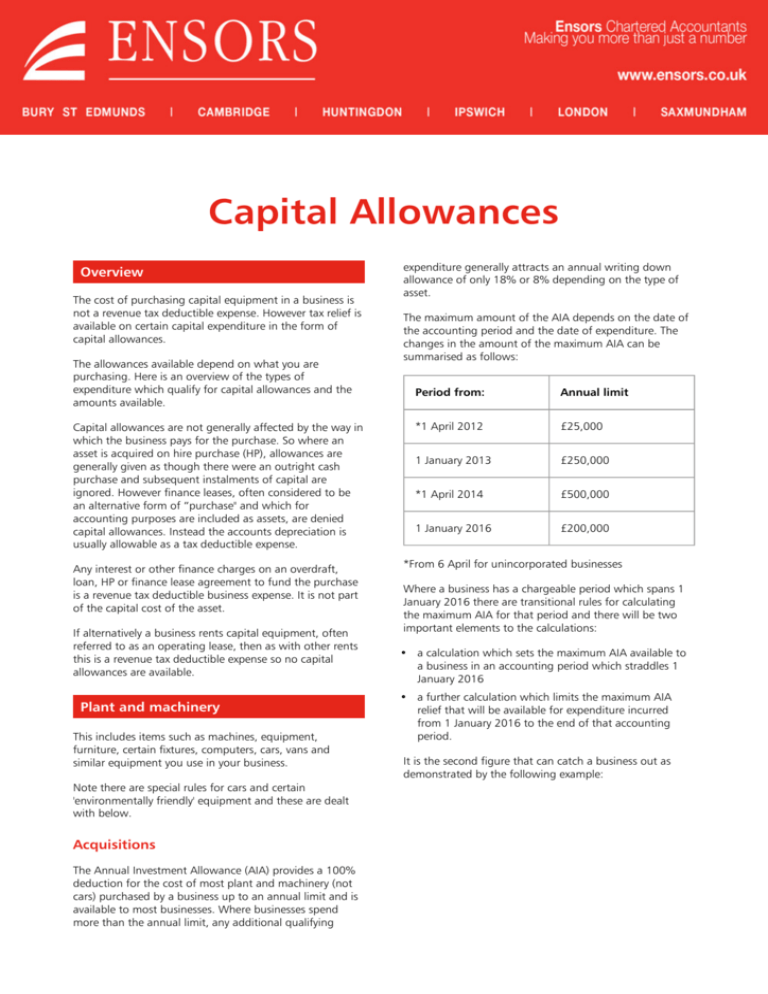

. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc. Up to April 2021. But you or he.

Under the Capital Allowances Act 2001 section 38B the cost of a car is not eligible for the AIA. Enhanced Capital Allowances ECA energy-saving and environmentally beneficial plant and machinery -100 ECAs in Enterprise Zones until the later. Learn why car allowance is taxable how you can create a fair vehicle program with Motus.

Work out your capital allowances at the main rate 18 or the special rate 6 depending on what the item is. Ad Assessed for income and payroll taxes auto allowances cost businesses employees more. Ad Car allowances cost you AND your employees money and decrease productivity.

If so you may have considered purchasing a vehicle and writing off the purchase expense in your taxes. Reduce the amount of capital allowances you can claim by the amount you. The main pool allowances of 18.

The capital allowances rate is 18 per annum for cars emitting 51-110GPKm. No more auto allowance tax waste. Optimize your enterprise with Cardata reimbursements.

The total capital allowances available will be AIA WDA 1054000 1000000 54000 Note if the above purchase was made in a 6 months period then the AIA would be. Capital allowances can be claimed on the costs of other motor vehicles such as vans lorries and motor cycles acquired for business use as well as on capital expenditure incurred on a foreign. If a vehicle has no emissions for more than a year and is in good condition it can claim a first years capital allowance of 100.

Optimize your enterprise with Cardata reimbursements. Capital Allowances and 100 deductions under the Annual Investment Allowance AIA have been with us for some time now and whilst you can claim AIA on most items of plant and. Learn why car allowance is taxable how you can create a fair vehicle program with Motus.

Capital allowances on cars. Such cars are treated as part of the general plant and machinery assets of the business and. When entering cars on a Ltd Co tax computation is it still possible to de pool them so BAs can be claimed when sold or do we.

For capital allowances a car is a type of vehicle that. Businesses are able to claim relief on many purchases including capital allowances on cars and vans. Capital Allowances on cars.

Qualifying expenditure QE QE includes. This means you can. Rules around Capital Allowances and cars.

When vehicles are purchased for sole business use they may or may not be eligible for the capital allowance. What Is The Capital Allowance On Electric Cars. You might even be able to write off other related expenses like gas.

Capital allowances tax rules for automobiles. The emissions-based capital allowances scheme for cars. The capital allowance regime provides traders with relief for the cost of buying cars and vans that are used.

Business cars and vans - claiming capital allowances. No more auto allowance tax waste. Theres nothing to stop him buying it through a company but your question does suggest that doing that would enable the company to claim capital allowances.

In most cases cars fall under the. 4 rows You can claim capital allowances on cars you buy and use in your business. When did accelerated capital allowances for cars start.

Section 67 Capital Allowances Act 2001 CAA 2001 allows the capitalisation of the entire expenditure on the vehicle from delivery providing the asset was in business use at. A guide for businesses. Ad Assessed for income and payroll taxes auto allowances cost businesses employees more.

However if the business is purchasing. The current capital allowance rates applicable to cars are as follows. However it can be.

The capital allowance rates which currently apply to cars allow 100 first year allowances on vehicles with a co2 emissions figure of 50gkm and under.

0 Comments